Table of Contents

Climate change is one of the most pressing issues facing our planet today. Urgent action is needed to reduce greenhouse gas emissions and mitigate the effects of climate change, and investment is a powerful tool that can be used to drive change.

Editor’s Note: This climate change investment guide was published on [date] to provide readers with the latest information on this important topic.

Our team of experts has analyzed the latest research and data to put together this comprehensive guide to climate change investment. We hope that this guide will help you make informed decisions about how to invest your money in a way that supports climate action.

Key Differences

| Feature | Climate Change Investment | Traditional Investment |

|---|---|---|

| Goal | To generate positive environmental and social impact | To generate financial returns |

| Risk | May be higher risk than traditional investments | May be lower risk than climate change investments |

| Returns | May be lower than traditional investments | May be higher than climate change investments |

Main Article Topics

- The importance of climate change investment

- The different types of climate change investments

- How to evaluate climate change investments

- The risks and rewards of climate change investment

- How to get started with climate change investment

Climate Change Investment

Climate change investment is an important and growing field. Here are 10 key aspects to consider:

- Environmental impact: Climate change investments should have a positive environmental impact.

- Social impact: Climate change investments should also have a positive social impact.

- Financial returns: Climate change investments can generate financial returns.

- Risk: Climate change investments may be risky.

- Diversification: Climate change investments can help to diversify a portfolio.

- Long-term investment: Climate change investments are typically long-term investments.

- Government support: Climate change investments may be supported by government policies.

- Investor demand: There is growing investor demand for climate change investments.

- Innovation: Climate change investment is driving innovation in clean energy and other technologies.

- Urgency: Climate change is an urgent problem that requires investment.

These key aspects highlight the importance of climate change investment. By investing in climate change solutions, we can help to create a more sustainable future.

Environmental impact

Climate change investment is a powerful tool that can be used to drive positive environmental change. By investing in renewable energy, energy efficiency, and other climate-friendly technologies, we can help to reduce greenhouse gas emissions and mitigate the effects of climate change.

There are many different types of climate change investments available, including:

- Investing in renewable energy companies

- Investing in energy efficiency projects

- Investing in sustainable forestry

- Investing in climate change adaptation projects

These investments can have a significant positive impact on the environment. For example, investing in renewable energy can help to reduce air pollution and greenhouse gas emissions, while investing in energy efficiency can help to reduce energy consumption and costs.

Climate change investment is an important part of the fight against climate change. By investing in climate-friendly technologies and projects, we can help to create a more sustainable future.

| Investment | Environmental impact |

|---|---|

| Renewable energy | Reduces greenhouse gas emissions and air pollution |

| Energy efficiency | Reduces energy consumption and costs |

| Sustainable forestry | Protects forests and biodiversity |

| Climate change adaptation | Helps communities adapt to the effects of climate change |

Social impact

Climate change investment is not just about environmental impact. It is also about social impact. Climate change investments can create jobs, improve public health, and reduce poverty.

- Job creation: Climate change investments can create jobs in the clean energy sector, the energy efficiency sector, and the sustainable forestry sector. These jobs can help to boost the economy and reduce unemployment.

- Public health: Climate change investments can improve public health by reducing air pollution and greenhouse gas emissions. This can lead to a reduction in respiratory illnesses, heart disease, and other health problems.

- Poverty reduction: Climate change investments can help to reduce poverty by providing access to clean energy, energy efficiency, and sustainable forestry. This can help to improve the lives of people in developing countries and reduce the impacts of climate change.

- Community resilience: Climate change investments can help to build community resilience to the effects of climate change. This can include investing in seawalls to protect coastal communities from flooding, or investing in drought-resistant crops to help farmers adapt to changing climate conditions.

These are just a few of the ways that climate change investments can have a positive social impact. By investing in climate-friendly technologies and projects, we can help to create a more just and equitable world.

Financial returns

Climate change investment is not just about environmental and social impact. It can also be a financially rewarding investment. There are a number of ways that climate change investments can generate financial returns, including:

- Reduced operating costs: Climate change investments can help to reduce operating costs by improving energy efficiency and reducing reliance on fossil fuels. For example, a company that invests in solar panels may see a reduction in its electricity bills.

- Increased revenue: Climate change investments can help to increase revenue by creating new products and services that meet the growing demand for climate-friendly solutions. For example, a company that develops a new type of electric vehicle may see an increase in sales.

- Improved investor relations: Climate change investments can help to improve investor relations by demonstrating a commitment to sustainability. This can lead to increased investment and a higher stock price.

- Government incentives: Many governments offer incentives for climate change investments, such as tax breaks and grants. These incentives can help to reduce the cost of climate change investments and make them more financially attractive.

These are just a few of the ways that climate change investments can generate financial returns. By investing in climate-friendly technologies and projects, investors can not only help to create a more sustainable future, but they can also generate financial returns.

Risk

Climate change investment is a complex and rapidly evolving field. As with any investment, there are risks involved. Some of the risks associated with climate change investments include:

- Policy risk: Climate change policies are constantly evolving, and changes in policy can have a significant impact on the value of climate change investments. For example, if a government decides to reduce subsidies for renewable energy, this could reduce the profitability of renewable energy investments.

- Technology risk: Climate change technologies are still in development, and there is a risk that they may not perform as expected. For example, if a new type of solar panel is developed that is more efficient and less expensive than existing solar panels, this could reduce the value of existing solar panel investments.

- Market risk: The market for climate change investments is still relatively small and illiquid. This means that it can be difficult to buy and sell climate change investments, and the prices of climate change investments can be volatile.

- Climate risk: Climate change itself poses a risk to climate change investments. For example, if climate change leads to more extreme weather events, this could damage or destroy climate change infrastructure, such as solar panels and wind turbines.

It is important to be aware of these risks before investing in climate change. Investors should carefully consider their investment goals and risk tolerance before making any investment decisions.

Diversification

Diversification is an important investment strategy that can help to reduce risk. It involves investing in a variety of different assets, such as stocks, bonds, real estate, and commodities. This helps to ensure that your portfolio is not too heavily concentrated in any one asset class, which can reduce your risk of losing money if that asset class performs poorly.

Climate change investments can be a good way to diversify a portfolio because they are not correlated to traditional asset classes. This means that they can help to reduce the overall risk of your portfolio.

- Facet 1: Climate change investments can provide exposure to new industries and technologies. For example, investing in renewable energy companies can give you exposure to the growing clean energy sector.

- Facet 2: Climate change investments can help to hedge against the risks of climate change. For example, investing in energy efficiency can help to reduce your exposure to the risks of rising energy costs.

- Facet 3: Climate change investments can be a source of alpha. Alpha is a measure of excess return, or the return that an investment generates above and beyond the benchmark. Some climate change investments have the potential to generate alpha because they are investing in new and innovative technologies.

Overall, climate change investments can be a valuable addition to a diversified portfolio. They can help to reduce risk, provide exposure to new industries and technologies, and generate alpha.

Long-term investment

Climate change investment is a long-term investment because the transition to a low-carbon economy will take time. It will take time to develop and deploy new climate-friendly technologies, and it will take time for businesses and consumers to adopt these new technologies.

- Facet 1: Climate change investments require significant upfront investment. For example, building a new solar power plant can require a large upfront investment. However, these investments can generate returns over a long period of time.

- Facet 2: Climate change investments can have long payback periods. For example, it may take many years for a company to recoup its investment in energy efficiency measures. However, these investments can lead to significant savings over the long term.

- Facet 3: Climate change investments can be exposed to regulatory and policy risks. For example, changes in government policy can affect the profitability of climate change investments. However, these risks can be mitigated by investing in a diversified portfolio of climate change investments.

- Facet 4: Climate change investments can contribute to long-term economic growth. By investing in climate change solutions, we can create new jobs and boost economic growth.

Overall, climate change investment is a long-term investment that can generate financial returns and contribute to a more sustainable future. Investors should be aware of the long-term nature of climate change investments and consider their investment goals and risk tolerance before making any investment decisions.

Government support

Governments around the world are increasingly recognizing the importance of climate change investment. As a result, many governments are implementing policies that support climate change investments. These policies can take a variety of forms, including:

- Financial incentives: Governments can provide financial incentives to businesses and individuals who invest in climate change solutions. These incentives can include tax breaks, grants, and low-interest loans.

- Regulatory support: Governments can implement regulations that make it easier and more affordable to invest in climate change solutions. For example, governments can streamline permitting processes for renewable energy projects.

- Public investment: Governments can invest directly in climate change solutions. For example, governments can invest in renewable energy research and development, or in the construction of climate-resilient infrastructure.

- Government procurement: Governments can use their purchasing power to support climate change investments. For example, governments can purchase electric vehicles for their fleets, or they can require their suppliers to meet certain environmental standards.

Government support for climate change investment is essential to the transition to a low-carbon economy. By providing financial incentives, regulatory support, and public investment, governments can make it easier and more affordable for businesses and individuals to invest in climate change solutions.

Investor demand

The growing investor demand for climate change investments is a reflection of the increasing recognition of the financial risks and opportunities associated with climate change. As the world transitions to a low-carbon economy, there is a growing need for investment in climate change solutions.

- Facet 1: Climate change is a major financial risk. The physical and economic impacts of climate change are already being felt around the world, and they are only expected to become more severe in the future. This is leading investors to seek out climate-resilient investments and to divest from carbon-intensive industries.

- Facet 2: Climate change presents new investment opportunities. The transition to a low-carbon economy is creating new investment opportunities in renewable energy, energy efficiency, and other climate-friendly technologies. These investments can provide attractive returns for investors while also helping to mitigate the risks of climate change.

- Facet 3: Investors are increasingly seeking sustainable investments. Many investors are now seeking out investments that align with their values and that contribute to a more sustainable future. Climate change investments can meet this demand by providing investors with the opportunity to invest in companies and projects that are making a positive impact on the environment.

- Facet 4: Government policies are supporting climate change investment. Many governments around the world are implementing policies that support climate change investment. These policies include financial incentives, regulatory support, and public investment. This is making it easier and more attractive for investors to invest in climate change solutions.

The growing investor demand for climate change investments is a positive sign that the world is moving towards a more sustainable future. By investing in climate change solutions, investors can not only generate financial returns, but they can also help to create a more sustainable and resilient world.

Innovation

Climate change investment is driving innovation in clean energy and other technologies as the world seeks to transition to a low-carbon economy. This investment is helping to develop new and more efficient ways to generate, store, and use energy, as well as to reduce emissions and pollution.

-

Facet 1: Climate change investment is funding research and development of new clean energy technologies.

For example, the U.S. Department of Energy has invested in research on solar energy, wind energy, and geothermal energy. This research has led to the development of new and more efficient solar panels, wind turbines, and geothermal power plants.

-

Facet 2: Climate change investment is helping to commercialize new clean energy technologies.

For example, the U.S. government has provided loan guarantees to companies that are developing new solar and wind projects. These loan guarantees have helped to reduce the cost of these projects and make them more attractive to investors.

-

Facet 3: Climate change investment is creating new jobs in the clean energy sector.

The clean energy sector is one of the fastest-growing sectors of the economy. In the United States, the clean energy sector employed over 3 million people in 2020. These jobs are in a variety of fields, including engineering, construction, and manufacturing.

-

Facet 4: Climate change investment is helping to reduce emissions and pollution.

Clean energy technologies can help to reduce emissions of greenhouse gases and other pollutants. For example, solar energy and wind energy do not produce any emissions, and electric vehicles do not produce any tailpipe emissions.

Climate change investment is essential to the transition to a low-carbon economy. By investing in clean energy and other technologies, we can create a more sustainable and prosperous future.

Urgency

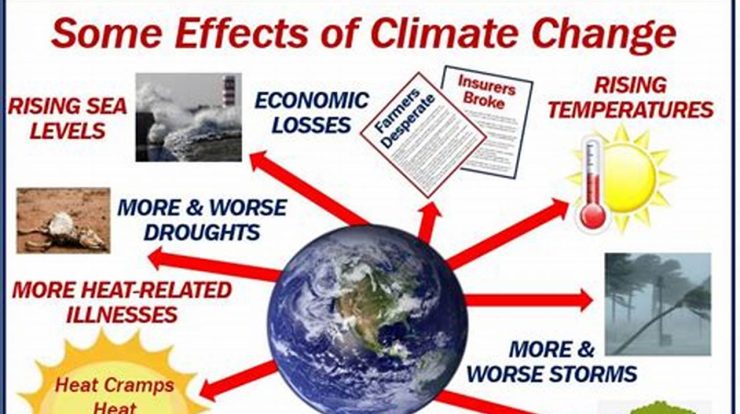

Climate change is one of the most urgent problems facing our planet today. The effects of climate change are already being felt around the world, in the form of more extreme weather events, rising sea levels, and changing plant and animal life. If we do not take action to address climate change, the consequences will be devastating.

-

The cost of inaction is too high.

The longer we wait to address climate change, the more it will cost us. The cost of inaction includes the economic costs of climate change, such as the costs of rebuilding after extreme weather events and the costs of adapting to rising sea levels. It also includes the human costs of climate change, such as the loss of life, the displacement of people, and the spread of disease.

-

Climate change investment can help us avoid the worst impacts of climate change.

By investing in climate change solutions, such as renewable energy, energy efficiency, and sustainable agriculture, we can reduce greenhouse gas emissions and mitigate the effects of climate change. Climate change investment can also help us to adapt to the effects of climate change, such as by building sea walls to protect coastal communities from flooding.

-

Climate change investment is a smart investment.

Climate change investment can generate financial returns, as well as environmental and social benefits. For example, investing in renewable energy can help to reduce energy costs and create jobs. Investing in energy efficiency can help to reduce operating costs and improve productivity. And investing in sustainable agriculture can help to improve crop yields and reduce food insecurity.

-

We need to act now.

Climate change is an urgent problem, and we need to act now to address it. Climate change investment is an essential part of the solution. By investing in climate change solutions, we can create a more sustainable and prosperous future for all.

The urgency of climate change requires that we make significant investments in climate change solutions. These investments will help us to avoid the worst impacts of climate change, generate financial returns, and create a more sustainable future.

Climate Change Investment FAQs

This section provides answers to frequently asked questions about climate change investment.

Question 1: What is climate change investment?

Climate change investment is an investment in companies, projects, or technologies that are designed to reduce greenhouse gas emissions and mitigate the effects of climate change.

Question 2: Why is climate change investment important?

Climate change is one of the most urgent problems facing our planet today. Climate change investment is essential to reducing greenhouse gas emissions, mitigating the effects of climate change, and creating a more sustainable future.

Question 3: What are the different types of climate change investments?

There are many different types of climate change investments, including investments in renewable energy, energy efficiency, sustainable agriculture, and climate change adaptation.

Question 4: How can I make a climate change investment?

There are many ways to make a climate change investment. You can invest in climate change funds, invest in individual climate change companies, or invest in climate change projects.

Question 5: What are the risks and returns of climate change investment?

Climate change investment, like any investment, carries some risks. However, climate change investment can also generate financial returns, as well as environmental and social benefits.

Question 6: What is the future of climate change investment?

The future of climate change investment is bright. As the world transitions to a low-carbon economy, there will be a growing need for investment in climate change solutions.

Climate change investment is an important part of the solution to climate change. By investing in climate change solutions, we can create a more sustainable and prosperous future for all.

Next Section: Climate Change Investment Resources

Climate Change Investment Tips

Climate change investment is an important and growing field. Here are five tips to help you make informed climate change investment decisions:

Tip 1: Understand the risks and returns of climate change investment.

Climate change investment, like any investment, carries some risks. However, climate change investment can also generate financial returns, as well as environmental and social benefits.

Tip 2: Diversify your climate change investment portfolio.

Don’t put all your eggs in one basket. Invest in a variety of climate change investments, such as renewable energy, energy efficiency, and sustainable agriculture.

Tip 3: Invest for the long term.

Climate change investment is a long-term investment. Don’t expect to get rich quick. Be patient and invest for the long haul.

Tip 4: Do your research.

Before you invest in any climate change project, do your research. Make sure you understand the project and the risks involved.

Tip 5: Seek professional advice.

If you’re not sure how to get started with climate change investment, seek professional advice from a financial advisor.

By following these tips, you can make informed climate change investment decisions and help to create a more sustainable future.

Conclusion: Climate change investment is an important part of the solution to climate change. By investing in climate change solutions, we can create a more sustainable and prosperous future for all.

Conclusion

Climate change investment is an essential part of the solution to climate change. By investing in climate change solutions, we can reduce greenhouse gas emissions, mitigate the effects of climate change, and create a more sustainable future.

Climate change investment is a complex and rapidly evolving field. However, by understanding the risks and returns of climate change investment, diversifying your portfolio, investing for the long term, doing your research, and seeking professional advice, you can make informed investment decisions and help to create a more sustainable future.

Youtube Video: